Looking to buy backpacker travel insurance?

If you are feeling intimidated by the number of options or bored by the prospect of reading T&Cs of the different travel insurance providers, we are here to help.

These 11 questions will help you quickly figure out whether an insurance provider is a good match for you or not.

Bonus? By asking the questions, you will avoid the mistakes many travellers make.

Sounds good? Then let’s get started.

Note: This post doesn’t just list 11 questions you should ask. It is packed with tips and info so that you make the right decision when choosing your backpacker travel insurance.

What we are trying to say is, don’t just skim through it.

Get a nice cup of tea and read it all.

We promise it’s more entertaining than reading insurance T&Cs.

This post may contain affiliate links. For more information, please read our Disclaimer.

Here’s a little bit about our journey, if you are new here! If you know us, feel free to skip this part.

After leaving our old life in Scotland in March 2022 (it rains too much there), we travelled full-time for almost 2 years. Sounds fancy, doesn’t it? Well, it was. If you think that carrying overpacked backpacks in 45°C heat around streets that aren’t even on Google Maps is fancy. And that’s just 1% of all the fun we had! 😆

During the 2 years we volunteered in Italy and Bulgaria (free travel while learning new skills, anyone?), explored other amazing European countries and backpacked Southeast Asia. Btw, even our secret wedding was more of an expedition than a wedding. 😅

And, of course, we researched and planned everything ourselves, because you gotta keep the budget low, right? If you are like us, you’ve come to the right place, because we want to share all the useful travel tips and info with you!

Excited? Good. Let’s get into it so you can go on your own epic adventures too!

Backpacking and safety

Safety is a big concern for many travellers, so as always, we are here to offer the solutions we have discovered on our journey.

This post talks about the questions you NEED to consider before buying backpacker travel insurance.

But there are other things you can do to make your travels safer.

Have you heard of this super simple hack, for example?

Do you know how to keep your backpack safe?

And how about, instead of spending a lot on insurance to cover phone damage, you take better care of it with this £1.34 trick?

Recommended backpacker travel insurance

When choosing insurance for your travel adventures, you want someone awesome to cover you.

Someone reliable, friendly and who offers great value for money.

Someone who will have your back when it matters, rather than whipping out a list of exceptions that mean you don’t qualify for coverage.

When planning our full-time travels, we wanted someone like that.

And so we researched 23 different backpacker travel insurance providers.

We asked the 11 questions from this article.

And we found 2 companies that we are happy with.

Wondering who our top choices are?

SafetyWing and True Traveller. They are both great, both were created by travellers for travellers, and both offer amazing value for money.

And what’s more, both passed our 11-question test!

A note on bad insurance companies

We do think there are bad insurance providers out there. Absolutely yes.

There are many insurance companies who offer all kinds of products just to make a profit. But they don’t understand the specific needs of long-term travellers and, what’s more, they don’t care.

That is why we recommended SafetyWing and True Traveller to you. Because they are different.

But we also think something else.

Controversial opinion on travel insurance: incoming.

Our controversial opinion

You will find many negative reviews for different travel insurance providers.

And we are not saying that all of them are unjustified. Definitely not.

But, we do think that many times people end up not happy with their insurance provider because of their own mistake.

They buy travel insurance and assume everything in every situation is covered.

And then they are unhappy when their claim gets rejected.

They forget to do the most important thing.

The best piece of advice for buying backpacker travel insurance

Always, always, always read the T&Cs.

Yes, they are boring and soul-destroying.

But you need to make sure you understand what your insurance actually covers vs what you are just assuming it covers.

Yes, it might suck when your claim gets rejected on a technicality. But if those are the rules that you agreed with in the T&Cs, it’s not the provider’s fault.

Note

We are not trying to fight for insurance providers here.

What we are trying to do is make sure you don’t make a mistake and end up like the grudge-holding 1* reviewers online.

Read the T&Cs.

Thank us later.

(Also, read this post, if you want more detailed rant on bad travel insurance companies and our controversial opinion.)

(the company name has been redacted because the purpose of the image is to explain the problem of 1* reviews, not to talk about a specific provider)

The purpose of the 11 questions

You might be wondering: “At the start, you guys told me I just need to ask these 11 questions, and now you are telling me to read the T&Cs!”

Aha!

We are happy you are paying attention.

Here is how we would suggest you approach the tedious task of selecting a backpacker travel insurance provider:

4 steps to picking a backpacker travel insurance provider:

- Make a list of providers. Ideally in a Google Sheet (🤓)

- Go through the 11 questions to quickly pre-approve or dismiss each provider

- Once you have a shortlist of those who passed, compare prices

- When you are down to around 2 or 3 top choices, read their terms and conditions to find the best fit for your travels

This approach will save you A LOT of time and energy. Possibly a few meltdowns too.

We’ve also got a pro tip for you that will speed things up even more. Yay to efficiency!

Pro tip

Before getting into the 11 questions, we’ll share a pro tip with you:

Identify your dealbreaker question early on and use it to sort through the different travel insurance providers fast.

For example, we knew that we would be buying our backpacker travel insurance when we were already travelling.

Frustratingly, many companies don’t cover you if you are already exploring the world (more on this in question no. 3).

The bright side of this?

We could easily discard many travel insurance providers by checking whether they offered this option right at the start.

Another example might be that you have a medical condition that you need covered (more on this in question no. 5).

Instead of reading through the full offer or T&Cs, just check the pre-existing conditions section or message the company directly to ask.

You will save yourself hours of work, if you lead with your dealbreaker question.

Question zero: To buy or not to buy

We know we said 11 questions, but first, we have to address the common dilemma of all backpackers:

Do you even need backpacker travel insurance?

It’s kinda linked with our question no. 1 below, because it is true that travel insurance providers offer many expensive premium features with their plans. Features you probably don’t need.

A simple trick

Here is a simple trick we used when we were deciding whether to buy backpacker travel insurance for our adventures:

The best way to decide whether to insure something is by imagining having to pay for it if something goes wrong.

This is what we mean:

Can you afford to replace your 2-year-old phone if something happens to it? Yes? Don’t insure it.

Can you afford to pay hundreds or thousands of pounds/dollars/not Monopoly money if something happens to you as you climb up a mountain and you have to be helicopter-rescued and operated on? No? Get insurance.

Now, when backpacking or travelling long-term in any other (more pleasant) way, you don’t know what’s going to happen.

If you do, please DM us on our Instagram. We have some questions to ask. 👀

So unless you are a backpacker with unlimited funds (lol) or you are planning on travelling in one of those human bubble balls, get travel insurance.

Side note on the human bubble ball: even that isn’t a 100% guarantee, if you think about it. Because you can get ill inside of it. Or it can burst just as you are rolling down a steep hill in the Lao countryside. Also, how do you check into a hotel in that? Go to a restaurant?? This is starting to look like a not-very-feasible idea. Just get the travel insurance instead.

(pictured: us, rock climbing in Cambodia)

Question no. 1: What is covered by the backpacker travel insurance?

This might seem like an obvious one, but not all travel insurance is equal.

Here is what we would suggest you do:

3 steps to figuring out backpacker travel insurance

First, make a cup of tea and get yourself a biscuit or two while you are in the kitchen. This process is not fun, so you might as well come prepared.

Second, learn a bit about travel insurance in general. Look up what you should be covered for and make sure you understand the terminology.

Now, we aren’t suggesting you turn yourself into a lawyer or bore yourself to death right within the first 20 minutes.

But you should know at least the basics, such as understanding what an insurance premium and excess is or what personal liability is.

Third, think about what you really need.

Many insurance companies like to throw in all sorts of premium features, making you feel like you will be covered for everything.

The key is not getting carried away.

Consider what you actually might need, using the trick from question zero.

Usually, companies offer multiple plans and add-ons you can choose from. Compare the differences and see if they are necessary for you and worth the extra cost.

We are not financial experts. But if you want our opinion or personal experience, you can always book a chat with us, so we can talk through your plans together, and help you figure it all out!

Something to consider

When we were researching backpacker travel insurance for our full-time travels, we came across an interesting opinion.

It’s kinda like what we suggested in question zero.

The opinion: medical or liability bills (if you injure someone else, for example) can be high. Get insured for them. But insuring technology is not worth it.

Of course, there are caveats to this opinion.

Such as, if you are a content creator who travels with gear worth £££££ and it’s the source of your whole livelihood, you might want to insure it.

But.

Insuring your 2-year-old phone might not be the best economical decision.

Example

Here’s an (exaggerated) example: say you pay £20 extra per month for your phone to be insured as you travel.

Your coverage limit for devices is up to £500 – meaning if anything happens to your phone, you can get max £500 for it.

On top of that, your phone is 2 years old, so your travel insurance provider has assessed its value at 80% of the original price. This means you wouldn’t even get the full £500. You’d get just £400.

Now, let’s say that in a year of travelling, nothing happens to your phone.

But by paying £20 every month to have it insured, you have lost £240 over the year.

Yes, this is the gamble with all insurance.

The point here is the value for money.

You pay £240 to potentially get £400.

IF something happens. Which it might not.

Compare this with the value for money you get if anything happens to you medically.

If you pick a good travel insurance provider, you pay a few hundred £ for a year of travel.

Then, if you do happen to have a medical emergency, the insurance will cover you for thousands and thousands £ spent at a hospital.

You pay a few hundred £ to potentially not have to pay thousands of £.

The solution

Do the math. Like we did in the example.

If you are not sure about any premium features, check what the coverage limit is and read any small print restrictions.

Add up how much extra the premium will cost you and then see if it’s worth it.

You might be surprised how many times it is not.

Question no. 2: Do I have to select specific countries?

This might seem a bit silly, but it can be a dealbreaker.

Do you have to list the countries you are travelling to, one by one? Or does the insurance provider let you pick a region, such as Southeast Asia or, even better, worldwide?

What you need depends on your trip.

If you are only going on a short trip to two countries, it doesn’t make sense to pay more for a travel insurance provider who will cover you for the whole world.

On the other hand, if you are backpacking and you don’t know which countries you will visit, find someone who divides the planet into big regions.

For example, True Traveller offers 4 options for their Backpacker Travel Insurance:

- Europe, inc. Morocco, Egyp and Israel

- Australia and New Zealand

- Worldwide excluding USA and Canada

- Worldwide – all countries inc. USA and Canada

You just have to select the group that fits your travels – no need to list individual countries!

Question no. 3: Can I buy the insurance while abroad?

This was one of the most surprising discoveries for us.

Most travel insurance providers don’t actually allow you to buy travel insurance if you are already travelling!

You have to be based in your home country at the time of the purchase and start your trip there. Some even won’t insure you if you reside abroad for a certain number of months prior to the purchase!

It’s wild!

Why this can be a problem

Scenario 1

It might be that you are covered by some form of travel insurance at the moment, for example, through your work. So you start your travels with this coverage. However, this travel insurance will expire in the near future, and after that, you might want to buy backpacker travel insurance for your adventures. Fair enough, right?

Well, with many companies, you won’t be able to unless you first return to your home country!

Scenario 2

Another possible scenario: you might be leaving for your backpacking travels, but first you want to stop by in a different country – for example to visit your family for a month. You want your backpacker travel insurance to start after that first month.

Again, not possible with many insurance providers.

The solution

Always make sure you confirm this in T&Cs or somewhere on the website.

For example, True Traveller asks you whether you are already travelling right away – it’s part of the form you fill out to find out how much your policy would cost!

This is the kind of approach we were looking for – a company that understands travellers and caters to their specific needs.

As always, if you are not sure whether you can buy your backpacker travel insurance AFTER you leave your home country, reach out to the provider to ask.

Question no. 4: Can I renew the insurance from abroad?

This question is linked with question no. 3, in a way.

Here is how:

Some providers won’t insure you unless you are purchasing from your home country and starting the trip there. We’ve covered this crazy restriction in the previous section.

But.

You might already be thinking: “Well, how does that work if I need to extend??”

The problem

Scenario 1

You are on a long-term backpacking trip with no set dates. You buy insurance for a year but then discover you did a great job saving money and still have funds leftover to travel for a few more months.

You want to extend your policy with the current backpacker travel insurance provider, but you can’t. It’s not an option as you always have to buy the policy from your home country and guess what – that’s not where you are at the moment!

Scenario 2

You are 3 months into your 6-month sabbatical trip around the world when you realise you are absolutely loving it and want to travel longer (no wonder!).

You speak to your employer, and yes, they agree to extend your sabbatical. You speak to your airline and change your return ticket for a small fee. Done. You check your savings, and yes again – you are fine there too!

Just one last thing left. You need to extend your insurance.

Muhaha, you thought it was all going well, right? Not anymore. You discover extensions are not allowed.

The solution

There are two solutions for these situations:

Solution no. 1

If you are already travelling and you need to extend your policy, you can look for a new travel insurance provider who will insure you even though you are already travelling (see question no. 3) instead.

It does mean you have to spend some of your precious travelling time researching this, though. You will also have to make sure you are properly covered and there are no gaps as you change between the providers (check for the waiting period of your new insurance provider).

Solution no. 2

You can be smart and pick a travel insurance provider who allows extensions, right at the start of your trip. That way, if your situation changes, you can extend without having to do any research or trying to match up policy days.

Here are two examples of great travel insurance providers who offer this:

SafetyWing – their Nomad Insurance works like a subscription. You pay every 4 weeks until you decide to cancel. No need for extensions. Perfect if you are REALLY not sure when your trip will end.

True Traveller – any of their Single Trip policies can be extended by up to a year. And you can even get a 10% discount on the extension! (T&Cs apply). This is why we chose True Traveller to cover us on our backpacking adventures.

Question no. 5: Are pre-existing conditions covered?

Let’s face it.

We all have some issues. If you don’t, you can’t be our friend.

Just kidding!

You can still be our friend, we’ll just secretly be hating on you. 😆

But seriously, let’s talk about medical issues and travel insurance.

First of all, can you still get insured even if you have a medical condition (or two)?

Generally speaking, yes.

This is usually referred to as pre-existing conditions and you will most likely be asked some questions about them.

What you need to know about pre-existing conditions

- Some insurance providers will ask you about your medical conditions but some won’t. If you are concerned about your condition being covered, speak to the provider.

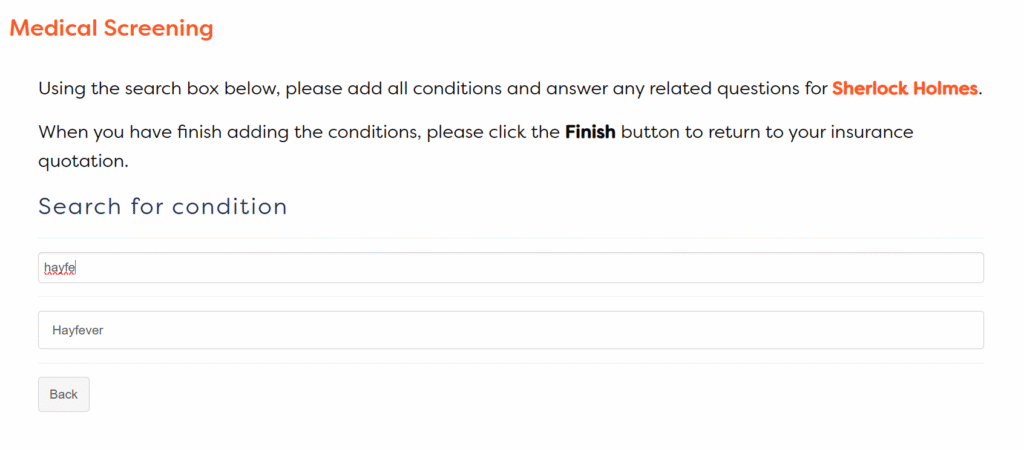

- You might get asked just to name your conditions or you might get asked to provide further information/fill out a questionnaire. There is no standard, it differs from company to company.

- It’s important to know what the look-back period is. This is the time during which any of your medical issues will be taken into consideration. For example, if a provider says their look-back period is 2 years, it means that you legally have to list everything you have been treated for or diagnosed with by a medical professional during those 2 years. Even if it was something common like a hay fever or flu.

- Some travel insurance providers don’t cover pre-existing conditions. Some cover a list of standard conditions such as asthma. Some cover even more serious conditions.

- In terms of price, it again depends on whether the pre-existing condition is covered or not. If it is, you might have to pay a premium on top of the standard rate based on the number of medical conditions you have.

What we would suggest you do

If you have a serious medical condition or one that you are worried about, this might be your dealbreaker question. In that case, definitely start with that when researching backpacker travel insurance providers so you don’t waste your time.

Almost all providers have a quote generator on their website. Pop your info in and see whether you get asked about pre-existing conditions too.

If yes, great. Read the fine print to know what the insurance company is offering.

If not, dig deeper to confirm what the policy says about pre-existing medical conditions.

(Btw. do you also use book characters’ names when you need a fake persona, or is it just us? 😆)

Question no. 6: Can I buy travel insurance on a one-way ticket?

If you are a full-time traveller who is planning on exploring indefinitely, till money lasts or till you find a new place to call home (aka “find yourself”. Btw if you do find a fab place to live in, let us know, we are still on the lookout!), you might struggle finding a travel insurance provider.

Why?

Because most of the traditional insurance providers won’t insure you without a return ticket. And not just any return ticket – a return ticket to your home country!

If you think that’s crazy, you are not alone.

We thought the same.

But it goes hand in hand with the insanity of question no. 3 – if you are required to start your trip (and your insurance) in your home country, you are often required to also end your trip there.

What does this mean?

It means you have to submit your return flight or other form of transport details when you are buying your travel insurance.

!!!

We know.

It’s totally crazy.

Who even books flights that far in advance?? (talking about long-term travel here, of course)

The solution

So what can you do?

Well, you have to check this when you are looking into the different travel insurance providers.

It might even be your dealbreaker question (if you don’t know what we mean by this, read the intro of this article).

If you are going on a one-way ticket journey, you have to make sure your insurance allows that.

For example, True Traveller offers this option. And not only that, they offer it as part of their standard package, so if you are travelling one way, it won’t increase the price!

We left Scotland on a one-way ticket, so we were super happy that True Traveller still covered us.

Question no. 7: What activities are covered?

Surfing in Bali? Bungee jumping in New Zealand? Running with the bulls in Spain? (has anyone done this last one? If so, DM us!)

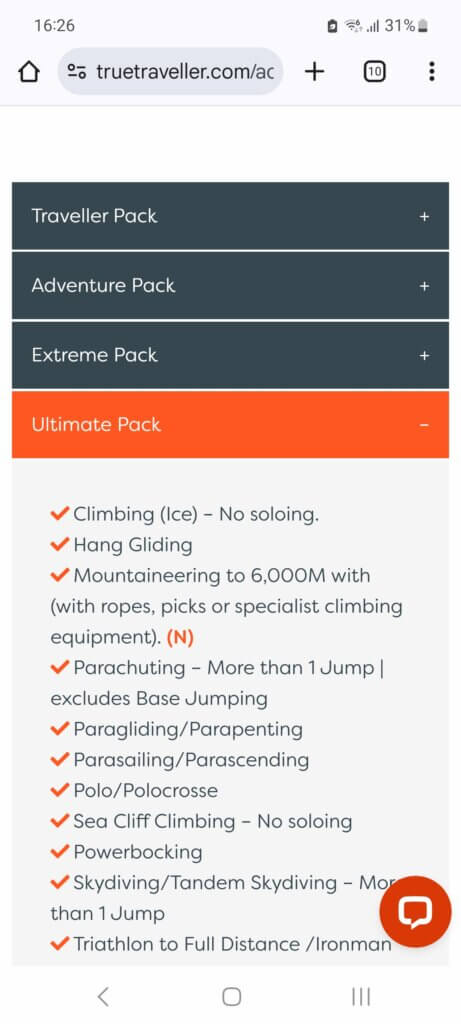

Most decent travel insurance providers cover a list of activities and sports as a standard.

And some even offer premium packages covering even more crazy stuff that you might get up to on your travels.

There are two things you have to think about here:

- What activities are you planning to do and are these covered?

- What happens if you decide to do an unplanned activity?

Let us explain.

Issue no. 1: What activities are you planning to do and are these covered?

It might be that you are doing a trip with a set itinerary, and so all your activities are planned out.

Great.

In that case, you can just check the list of the activities and sports the insurance provider covers and see if all your plans are included.

Issue no. 2: What happens if you decide to do an unplanned activity?

Let’s say you like to do things spontaneously.

Or that you are long-term travelling – maybe you are a full-time traveller, a digital nomad or a gap year backpacker. There is no way you will know in advance what activities and sports you will end up doing.

(That is unless you have a crystal ball in which case can we borrow it??)

When you are not sure what activities you will need to be covered for, you have two options:

Option A

You can check what are the basic activities covered by the travel insurance, as default, and see if that might be enough for you. Often, the more premium packages cover activities like hiking Kilimanjaro or skydiving, so if you know for sure that you don’t fancy that, you don’t have to buy the extra cover. Just get the basic insurance and you will be fine.

Option B

If you check the premium activities and think that you might end up doing some of them, check if you can add the premium cover later on.

If you can’t find the answer on the company’s website or in their T&Cs, message them directly to ask.

What we did

Messaging the provider if you can’t find an answer on their website is what we always recommend. That’s exactly what we did with True Traveller prior to buying from them.

They offer 4 activity packs – one standard that is included in all policies and 3 upgrades.

We were happy with the standard, for a start, but knew we might end up doing some activities from the upgraded packs.

We didn’t want to pay the premium for the upgrade though, in case we ended up not doing any of those activities.

So before buying our backpacker travel insurance, we reached out to True Traveller to ask them, if it’s possible to upgrade our activity pack even later on, while already having an insurance cover from them.

Amazing as they are, of course they said yes!

And so we knew that if we suddenly decided to go Canyon Swinging (a level 2 upgrade activity), we could upgrade our cover.

Don’t forget to do this

When checking for activities, make sure to read the fine print too. Usually, activities and sports are only covered if you are being reasonably safe – using all the right equipment, being with a professional or a guide, hiking on official trails only etc.

As we mentioned, you will find many bad reviews for insurance providers out there, but many times it is just the case of the person not having read the T&Cs properly and thinking they were covered.

Question no. 8: Can I visit home during my travels?

Did you know that you might void your backpacker travel insurance by visiting your home country?

Yep.

Many travel insurance providers include something along these lines in their T&Cs: “Coverage will be terminated immediately upon the insured’s return to their home country.”

For real.

Now, you might be thinking: “Ah, but I am not planning on popping over home while on my travels in South America.”

Okay, Jim. But that’s not how life works (we wish it did).

You might not be planning it, but you might need to do so.

For example, there might be an admin issue you have to deal with in person.

There might be a family medical emergency.

Or a really close relative or a friend might plan a short-notice wedding that you just can’t miss.

Even if you are not planning on visiting your home country while travelling, it’s good to have the option.

And if you are buying travel insurance for a year+ and spending £££ on it? It’s not just good to have, it’s necessary because imagine voiding such a policy just because you had to pop over home for a weekend!

What you should do:

- Make sure your travel insurance policy allows home visits.

- Check how many home visits are allowed – some providers, like True Traveller, allow unlimited visits, while others only allow a specific number.

- Check what the terms and conditions are during your home visit. Are you still covered by your travel insurance or is it paused for the duration of your visit home?

- If you can’t find clear information on this on the travel insurance provider’s website, reach out to them. Always get your answers before you buy.

Question no. 9: Is excess worth it?

First, what on earth is excess??

Cause that was our reaction when we started researching backpacker travel insurance.

To save you time googling, an excess is the amount of money you are willing to pay as part of your claim.

Example

You buy travel insurance with an excess of £100.

Let’s say you need to make a claim, for example, for having a dental emergency.

The visit to the dentist cost you £200, but your excess is £100, so you will only get £100 back from your insurance company. The other £100 is your responsibility to pay, because of the excess.

Why would you get backpacker travel insurance with excess?

Excess reduces the total cost of your insurance.

It is up to you to decide what you think works out better:

- Paying a higher amount for your insurance policy but not having to pay anything out of your own pocket, in case you need to make a claim

- Paying less for your insurance but then having to cover a part of your claim if something happens

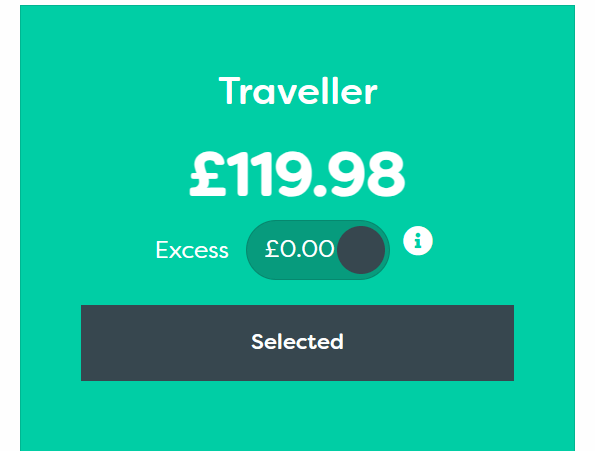

Excess – real-life example

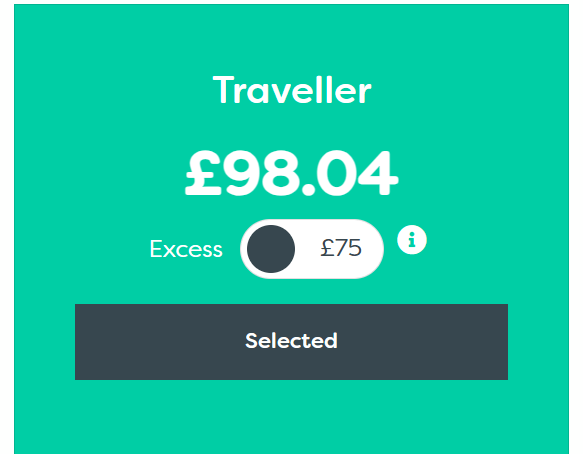

Let’s look at how excess changes the cost of insurance.

Taking True Traveller as the provider, we generated a quote for:

- 1 traveller, aged 32, from the UK

- Travelling worldwide but excluding USA and Canada

- Going away for the whole month of February 2025

- Not already travelling when buying the insurance

True Traveller offers 3 different policies.

Looking at their middle option – called “Traveller”, here are the prices:

What does this mean?

It means that if you go for the cheaper option, you save £21.94 right away.

But, if you do end up making a claim, you will have to cover the first £75 of it yourself.

Why would anyone bother with excess?

Well, it might be that you feel like travel insurance is not necessary. You still choose to go for it, but you want it to be as cheap as possible (while still having a decent cover). So you choose to save the extra money.

Or it might be that your chosen insurance provider offers a big saving on a policy with excess. In that case, if it saves you a lot of money upfront, you might conclude it’s a good deal.

Key things to know about excess

- Always do a calculation to see how much you will save on a policy with excess. Assess whether it’s worth it.

- Check the terms and conditions of your backpacker travel insurance to see which parts of the policy the excess applies to. Don’t assume it applies to the whole policy.

- Similarly, check how many times you can be liable to pay the excess. For example, True Traveller states in their T&Cs that excess is applicable to a maximum of two excesses being charged per insured incident. That means that if you are unlucky enough to get pickpocketed more than twice during the course of your trip, you will only have to pay the excess on the first two claims! Yay, silver lining!

Question no. 10: How far in advance can I book?

Yep, some travel insurance providers put limits even on this.

For example, some companies offer backpacker travel insurance only 1 month in advance.

Why this matters

Now, you might be thinking: “Why does it matter when I book?”

It might not.

But maybe you know your last month before your backpacking adventures is going to be wild.

Cause trust us, chances are, it will be. Actually worse than wild.

If you have to finish up in your job, attend all goodbye parties, get your gear in order, pack up your home, move things to storage, cancel all bills… The list is endless.

And so you might want to get as much done as you can early on.

Including researching and buying insurance.

Btw if you need help with figuring out what exactly you need to do before setting off into the sunset, here is a list of 8 essential things. Lots of tips included as well, of course!

And if it all feels like a bit too much, we feel you.

Our pre-travel time was super challenging – we wrote about that too, so you don’t feel alone.

The solution

Just check what the timeframe is on booking via your chosen insurer.

If they only allow you to book closer to the time, make sure you add it to your pre-travel to-do list.

Add it to a calendar as a notification too, because you don’t want to forget and then realise you are travelling without insurance.

Especially if your provider doesn’t let you buy the insurance once you leave your home country.

But we’ve already covered that and trust that you are smart and won’t pick someone like that.

Question 11: What’s the communication with the insurance provider like?

This is a big one.

We would actually go as far as to say that if you can’t decide between 2 or 3 providers, this point should be the deciding one.

What is the communication with the travel insurance provider like?

First, let’s talk about why this matters.

Why this matters

If something happens as you are travelling and you need help, the last thing you want is having to fight with your insurance provider.

Having an accident, falling seriously ill or having your phone stolen are already stressful enough situations. You really don’t want to also be dealing with endless paperwork. Or worse, being told that you are actually not covered for this incident. Or having your insurance provider not answer any of your queries.

So how can you “test out” the insurance provider’s communication prior to buying?

There are a few things you can do:

- Obviously, start by looking at their website. Notice how they talk about their products.

- Check out their social media pages. Are they active? Do their accounts look like it’s the 21st century, or are they stuck in prehistoric times?

- You can look up any news articles about the insurer too – how does the CEO communicate in the press? Or anyone else from the company?

- Do they respond to reviews? Good and bad ones? Pay attention especially to the negative ones – do they try to help or just dismiss the person?

- A must: check out what their customer service options are. 24/7 phone or online chat support should be the minimum.

- Another thing is to check what the claims process is like. How do you submit a claim? Is it all simple, straightforward and online? Or do you need to send a carrier pigeon? Important to know in advance.

- Most importantly, though, reach out directly.

Why you need to reach out to your travel insurance provider

It’s absolutely crucial that you reach out to the potential travel insurance providers prior to buying from them.

Why?

The reason we mentioned at the start of this question.

If they are terrible at talking to you now, when they should be trying to win you over as a customer, how bad is it going to be once they have your money?

The easiest way to check this is by asking the insurance provider a few questions about their backpacker travel insurance. Ask for clarification about something. Or about anything that you can’t find on their website.

What to look out for when talking to insurance providers

Here is what you should look out for in their answer (aside from them actually answering your question, of course!):

- First of all, as we said, check how easy it was to contact them. For example, could you just message them on Instagram, and they got back to you with good info, fast? Great.

- Speed. Are they fast at offering help, or do they take ages to get back to you?

- Tone of voice. Is it friendly? Or unnecessarily serious?

- Answers. Do they give you a straight, clear answer or just a bunch of vague jargon to try and confuse you?

- General vibe. Do they make you feel like a valued future customer? Or do you just seem like another customer query to them?

What we did

We tested our shortlisted backpacker travel insurance providers. Of course!

This is why we recommend True Traveller and SafetyWing.

We have spoken with people from both companies multiple times – prior to buying and also afterwards.

And we always got responses that were:

- Fast

- Friendly

- Complete (not answering just 1 out of your 5 questions)

- Straightforward

- Encouraging us to ask more if we still weren’t sure about things

Overall, a fantastic customer service, which gave us the confidence to buy. (Over the course of our travels, we’ve had travel insurance from both companies, True Traveller and SafetyWing, at different times).

So reach out. It costs you nothing, just a few minutes of your time, but it might save you many headaches in the future.

These are the 11 questions we recommend you ask prior to buying backpacker travel insurance.

It’s up to you to decide whether they are all relevant to you, but we hope they got you thinking.

If you have any questions about buying travel insurance, feel free to ask in the comments or DM us on our Instagram.

We are not financial experts, but we do always aim to get the best deal and to avoid making mistakes, and we are happy to share the tips and tricks we find along the way.

Hi!

We’re Mirka & Daniel — full-time travellers, professional overthinkers & bad luck magnets. We research EVERYTHING and then share all the weird travel tips with you here. Follow along to make your adventures easier! 🌴