This post is for you if you:

- Have had enough of looking at all the full-time travellers chilling on Thai beaches on a Monday morning.

- Decided that it’s something you want to pursue too – you’ll become a full-time traveller (and sip Pina Coladas in Bali on a Monday morning!)

- Are now sitting on your sofa, wondering: “Okay, but how much money should I save to travel?”

We’ll tell you the exact amount. And throw in some tips and tricks too, because we are nice like that. 😉

Have you noticed this post says Part 2? Well, spotted! We’ve got a whole Full-Time Travel Unpacked series where we spill all the sweaty juicy secrets of life on the road and what it really means to live out of a backpack (or a suitcase, if that’s more your vibe).

This post may contain affiliate links. For more information, please read our Disclaimer.

Here’s a little bit about our journey, if you are new here! If you know us, feel free to skip this part.

After leaving our old life in Scotland in March 2022 (it rains too much there), we travelled full-time for almost 2 years. Sounds fancy, doesn’t it? Well, it was. If you think that carrying overpacked backpacks in 45°C heat around streets that aren’t even on Google Maps is fancy. And that’s just 1% of all the fun we had! 😆

During the 2 years we volunteered in Italy and Bulgaria (free travel while learning new skills, anyone?), explored other amazing European countries and backpacked Southeast Asia. Btw, even our secret wedding was more of an expedition than a wedding. 😅

And, of course, we researched and planned everything ourselves, because you gotta keep the budget low, right? If you are like us, you’ve come to the right place, because we want to share all the useful travel tips and info with you!

Excited? Good. Let’s get into it so you can go on your own epic adventures too!

The secret to knowing how much money to save

Come closer.

We wanna share a secret with you.

Ready?

There isn’t one general number that fits all travellers.

Some people go to travel the world with £30,000.

Some with £10,000.

But we know why you are here.

You want to know how much YOU should save to travel.

And we’ll help you figure it out.

We just wanted to make sure that you know there’s a process. It isn’t a number someone else will be able to give you.

So, if you are ready, let’s get to it.

Warning

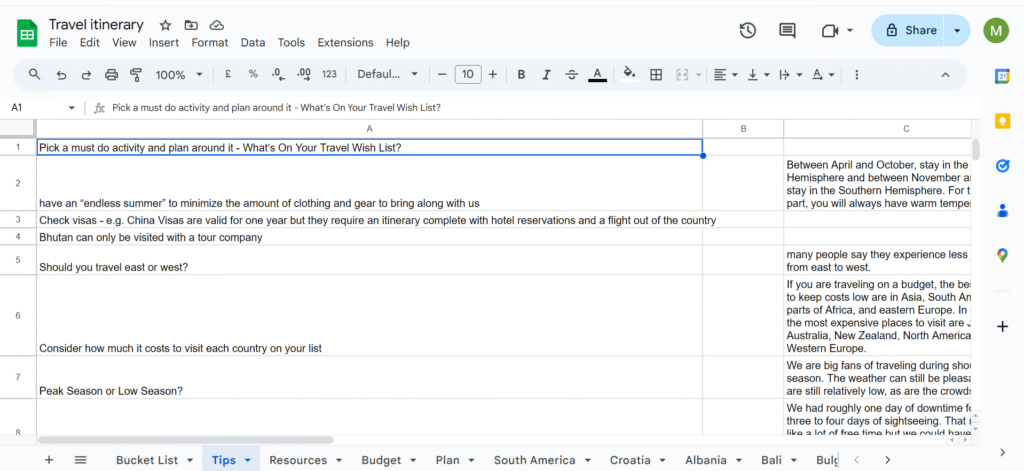

We will be using spreadsheets in this post. But also:

We all love spreadsheets (yes, you included!).

There will be no fancy calculations.

The spreadsheets really are just the easiest way to track your finances and do simple math calculations without risking that you’ll mess it up if you just use a calculator and your own typing skills.

So. Open up a Google Sheet. Give it a nice name. And let’s figure out how much money you have to save to travel.

How to calculate how much money you need to travel

To get to the big number, you have to consider a few things.

The type of travel you want to be doing. How long for. Where in the world, etc.

We’ll cover all of these below to help you figure it all out.

Remember, there isn’t one general number that applies to everyone.

Only you can determine how much money you need to save.

But we are here to help.

Consider each of the 5 questions below, and you will have your total number in no time.

Question no. 1: What type of travel do you want to do?

We went with the assumption that you want to be full-time travelling.

But you might have other plans.

Maybe you want to travel as a digital nomad. Working part-time and travelling part-time.

Or maybe you want to try volunteering. Now that’s a great way to travel AND save money at the same time. If you are wondering how you can do this, we wrote a full guide on volunteering abroad.

So decide on the kind of travel you want first.

In the example in this post, we’ll use full-time travel.

Question no. 2: What will be your style of travel?

Now that you’ve figured out the type of travel, you have to decide on your style.

And we don’t mean whether you will be walking around wearing heels or hiking boots!

Although, actually, we kinda do.

Because, if you are planning on being a backpacker, trust us, you can leave the heels at home.

So, what style are we talking about?

Well, you can be a budget traveller. Or a budget backpacker.

Of you can be a flashpacker. That’s definitely becoming more and more popular, as people realise they don’t have to give up all of their comforts while travelling – even while backpacking!

Basically, figure out what level of fanciness you want to be at when travelling.

A note on being fancy

It goes without saying, but the fancier you want your travels to be, the more you will need to save. So, be realistic.

For example, if you know that you can save up enough in 5 years to stay in 4* hotels instead of cheaper ones (or guesthouses) and you are willing to wait those 5 years? Go for it. The decision is yours.

We talked about this in more detail in the first part of our Full-Time Travel Unpacked series – How Do People Afford to Travel Full-Time? You can read it all here.

Question no. 3: How long do you want to be travelling for?

This is a big one.

3 months on the road will cost you a very different amount than a year.

Figure out how long you would IDEALLY like to be travelling for.

We say ideally, because all of these calculations are just estimates.

As you travel, you will need to track your spending and check against your savings (or income, if you will have any).

What might happen

It might be that you’ll discover you are spending way more than you budgeted (was it the rooftop bar cocktails in Istanbul? Or the best tiramisu in Venice? We totally understand both).

In that case, you might have to return from your travels earlier.

The opposite situation would be the better one.

You track your spending and discover you can make your savings stretch longer. Great! As long as you are okay staying away from your responsibilities (job, family, mortgage, etc.) for longer, you are sorted!

For the purpose of your financial planning, though, decide on how long you are aiming to travel. What’s your estimated time period?

Question no. 4: Where do you want to travel?

The countries you visit will probably have the biggest influence on your budget.

Why?

Well, there are expensive places in this world and then less expensive ones.

This is all relative, of course, but to simplify your planning process, let’s generalise a bit.

What we mean by expensive vs cheap is that, for example, 2 weeks in Paris might cost you the same as 6 months in Thailand.

This is why you have to decide where you want to travel.

Now, if you have no idea about the cost of travelling different countries, there are many resources that will help you.

Resources to check out

- Numbeo is a fantastic resource which gathers data on the cost of living around the world. Super helpful for people planning to emigrate, but you can also use it when planning your travels.

- Many travel bloggers share detailed costs of travelling in different countries. Check your favourite traveller’s site or do a quick google search: “[country] cost of travel blog”. For example, you could search for “Thailand cost of travel blog” to get a detailed breakdown from other travellers who visited Thailand. You can also add a year to make sure you are getting more current results, so: “[country] cost of living blog [current year]”.

- You can ask ChatGPT about the prices in a specific country or to generate a list of budget-friendly destinations for you.

What you are looking for when researching the cost of travelling different countries is the daily average cost. In other words, you want to find out (or figure out) how much you’ll spend each day in a given country.

That includes expenses like accommodation, sightseeing, food, transport etc.

(hint: cocktails don’t cost an arm and a leg there)

Alternative solution

If you are thinking that figuring out an average daily budget per country is undoable (and, frankly, a bit mental), we have a solution for you.

You can use this approach if you:

- Don’t have the time to figure out the daily budget per country

- Can’t be bothered figuring out the daily budget for each country

- Don’t know exactly which countries you’ll travel to and so are unable to calculate the budget

If any of this applies to you, you can go with an average daily budget estimate.

What does this mean?

This means that you will pick a number and try to make sure that your average daily budget is always that number (or around it).

How this works

For example, say you choose your average daily budget to be £60.

On day 1, for instance, say you are just chilling at the beach and eating street food. Your actual expenses for that day are £20.

But the next day you splash out – maybe do a guided tour of a local museum and you eat in a restaurant and have a cocktail too – living your best life! Your expenses for that day are £100.

The important thing is that your daily average budget stays on plan.

£20 (day 1) + £100 (day 2) = £120/2 (2 days) = £60 per day.

The reality

In real life, travel days aren’t quite as balanced out. This is why we would recommend you track your expenses daily and then calculate and check your average daily budget every month (or every week if you want to keep a closer eye on things).

How much should I estimate as my daily average?

Now, that’s a great question.

And you might even know the answer already.

Years ago, the idea of travelling the world on just $50 per day became popular. This was originally down to the book “How to Travel the World on $50 a Day“ written by Matt Kepnes, better known as Nomadic Matt.

Maybe you have heard of it?

Many other travellers have since:

- Travelled the world on this amount and talked about the tips and tricks they used to make it work.

- Adjusted the number to suit their specific needs, while still trying to keep it as low as possible.

Two things to consider about the average daily budget:

- You should understand how Nomadic Matt was able to travel so cheaply. You will have to make sacrifices and use different hacks to make that work. Find more information on his blog or read the book.

- Considering the book originally came out in 2013, a lot has changed since. Many countries have become more popular, and as a result, prices have gone up, inflation has skyrocketed, the funfest that was Covid changed the travel industry forever – the list goes on and on. In fact, things have changed so much that Nomadic Matt released a new book, this time titled “How to Travel the World on $75 a Day”. So, if you are thinking of getting one of them, you might want to consider this latest version.

What you should do

Here are the steps we would suggest you take:

- If you want to travel on a low budget, find out some information on travelling the world for $50/$75 per day, for example, by reading the book.

- If Nomadic Matt’s style of travel doesn’t suit you, see if your favourite travel blogger/Youtuber etc. has published their daily average cost and use that number.

- Adjust this daily average based on your unique situation. Use the questions from this post (where are you travelling, how long for, etc.).

If all of this is sounding overwhelming, don’t worry. We’d been there and it’s totally fine (and understandable, really) to feel this way. 🫶🏻 You can always book a chat with us, so we can talk through your plans together, and help you figure it all out (including these bloody calculations!)

We are almost ready to do the final calculation.

There is just one more question you have to consider.

Question no. 5: How many people will be using the budget?

Is it just you going travelling? Or do you have a partner? Or kids?

You might be thinking: “Well, won’t I just calculate a total amount for one person and then multiply by the number of people?”

Not quite.

Here is why.

How the number of people affects your calculations

Not everything will be a full price per person.

What do we mean?

Some things cost the full price as the number of people increases:

E.g. a bed in a hostel in a dormitory.

For example, 1 night for 1 person costs £15, and 1 night for 2 people costs £30.

But.

Take a hotel room.

For example, 1 night in the Marriott hotel in Phuket, Thailand, for 1 person costs £282.

The price for that same room, but for 2 people?

£282.

How come?

The price is per room, not per person, and the room’s capacity is two people.

So whether you stay there alone or with someone, the cost is the same.

An example with kids would be:

If you have a small child who will be sharing a room with you, don’t count them as an extra person.

If you have two older kids who will be staying in their own room, count them.

What this means for your calculations

You’ve got to make an educated guess based on what you are planning.

Accommodation is pretty easy:

If you are planning on staying in hostels, double up the budget.

If you are planning on sharing a room, you can do times 1.5 to give yourself some buffer.

But there are other areas where it might not be as simple to work out.

For example:

- Some insurance providers offer discounts for families or couples

- Some places have free public transport for small children

- Many sights have free or discounted entry for kids/students/seniors

- Kids might be eating from the kids’ menu rather than full portions

As we advised, try to make as good an educated guess as you can.

Here is what we did.

The solution

Back when travelling the world on $50 per day was still considered doable, many couples said they travelled together for $75 a day.

The logic behind this?

As we showed you above, not all expenses double for two people. Some expenses stay the same and get shared, or only increase partially.

So instead of counting $50 x 2 for a couple, travellers went with the estimate of $50 x 1.5 = $75.

And this is what we used as an estimate for our full-time travel budget.

The updated version

If you wanted to apply the same logic to the updated number from Nomadic Matt, here is what it would be:

The new daily average budget is $75 per person.

For two people then, the calculation is: $75 x 1.5 = $112.50.

Next steps

If you are now thinking: “Okay okay, I get all this. But how much should I save to travel??”

Don’t worry. We are about to tell you.

The thing is, we want you to have the full picture.

To make sure you don’t miss anything out.

It’s all estimates and guesses, but we want your calculation to be as close to reality, as possible.

That way, you won’t have to be dealing with financial issues as you travel the world. And that’s what we are all about – helping you solve your travel problems before they even arise!

So before we get to the actual final calculation, let’s look at two funds you might want to add to your main travel fund.

Two extra funds you have to consider

So far we have covered the travel fund.

We’ve covered the 5 questions you have to think about when creating your financial plan.

And shortly we will get to the actual calculations, so we can answer your question: “How much money should I save to travel?”

But first, we wanna talk to you about 2 more funds you might want to consider.

What do we mean by “funds”

Funds, in this case, refers to the different travel budgets or savings pots you might want to create.

The 2 extra funds

Aside from your main travel fund, which you will use to finance your travels with, there are 2 more funds you might want to create.

The emergency fund and the post-travel fund.

The emergency fund

What’s the emergency fund for?

Well, it’s pretty much what it says – for emergencies.

This is a certain amount of money that you put aside to use in the case of an emergency.

For example:

Let’s say you are travelling with a laptop because you are using it to run your blog as you travel.

And let’s say your laptop suddenly dies.

You don’t have it insured (or your insurance only covers a small portion of the replacement cost).

How do you pay for it?

Do you want to dip into your travel savings and sacrifice, for example, a month’s worth of travel for a new laptop?

That’s where the emergency fund comes in handy.

What else can you use it for

Basically, any emergency that you don’t wanna be spending your travel fund on.

For example, some other situations which can happen that you can use it for:

- Paying for flights if you have to suddenly fly back home because of an emergency situation

- Replacing your luggage if it gets stolen

- Booking new accommodation last minute if your plans suddenly change

How much should your emergency fund be

This entirely depends on you.

What can influence your number is:

- The number of people using the emergency fund (one person will need less than a whole family)

- How long you are travelling for (the longer you travel, the more likely emergency situations are to happen)

- How anxious a person you are (if like Daniel, not very anxious. If like Mirka, well, let’s just say the emergency fund is her idea. 😅)

For the purpose of the calculations in this post, let’s say you decide your emergency fund will be £2,000.

The post-travel fund

What’s the post-travel fund for?

The post-travel fund is used to cover your expenses once you finish your travels.

For example, you might have quit your job prior to setting off on your travels.

You know you will have to look for another job once you are back home.

How will you finance the days/weeks/months between you coming back and finding the new job?

Enter post-travel fund!

What else can you use it for

To replace anything you got rid of prior to your travels.

This might be things like:

- A car or a bicycle you need to get to your new job

- A deposit for renting a new home

- Furniture

- Other household items you might have sold

How much should your post-travel fund be

Again, as with the emergency fund, this is up to you to decide.

Here is how you can calculate your number:

- If you will be looking for a new job, estimate how long it might take you to get one

- Calculate your current monthly living expenses and then multiply them by the number of months you think you will spend looking for a job

- Add any of the other expenses we listed above (e.g. furniture you will have to replace)

- Consider your tolerance for risk. How much money would make you feel secure when thinking about your post-travel life?

For the purpose of the calculation in this blog, let’s say you want to be covered for 3 months of job-hunting once you are back from your travels.

Your monthly expenses are £1,500.

You will also need to buy a new sofa, for which you estimate a budget of £800.

Your calculation is:

3 (months) x £1,500 (monthly living expenses) + £800 (sofa) = £5,300.

Don’t forget this

You have so far answered the 5 questions about your travels. That’s great – they will help you figure out the total amount you need to save.

You have also considered whether you want to create the two extra funds – emergency and post-travel.

But there are a few other things you have to think about too.

The 3 categories to consider for your financial planning

- Pre-travel expenses. These are things like: vaccinations, travel insurance, travel gear (backpacks, clothes etc.), and the outgoing flight. Either budget for these as an extra expense or count them into the total you need to save to be able to travel.

- Expenses at home while you travel. Will you have any expenses at home, even when you are on the road? Perhaps you have to pay a mortgage. Or home insurance. Or you will be paying for a virtual mailbox service that will take care of your mail while you are away (by the way, this is one of the 8 things you have to remember to do before setting off on your travels). You might want to add these expenses up and then calculate how much they will cost you daily. Then you can add it as an expense to your daily travel budget.

- Any income you will have while travelling. Are you planning on working part-time while travelling? Perhaps you have a blog yourself that is making you some money on the side? Or maybe you will be renting out your property and have some income from that. This income can be taken away from the total amount you need to save, if you are sure you will have that money coming in, reliably, while you are travelling.

How much money should I save to travel then?

Now, for the big calculation.

Create a new tab in your Google Sheet for this, so you know this is the final number you are aiming for.

The calculation is pretty simple since you should have all the information you need by now.

The big calculation

This is what the big scary calculation looks like:

(Turns out, it’s not scary at all)

Number of days you want to be travelling for x your estimated average daily cost

So, for example:

If you want to travel for a year and you have calculated that your daily average cost will be £60, the calculation will be:

365 x 60 = £21,900

Do you have your number? Great!

Now add to it your emergency fund, if you want to have one.

In our example, it would be the emergency fund of £2,000 + £21,900 = £23,900

Remember to add to it your post-travel fund, if again you want to have one.

In our example, the post-travel fund is £5,300, so your calculation is £23,900 + £5,300 = £29,200.

And there is your answer to the question: “How much money should I save to travel.”

£29,200, which is your estimated total – how much you will spend while travelling, how much you will need when you return from your travels as well as a little bit of extra, should anything go wrong unexpectedly.

Note on your total number

We spoke about pre-travel expenses and how you can either budget for them in your total here, or just set some money aside for them.

If you want, you can add this amount to your total too.

For example:

Let’s say you know you need to get vaccinations, buy a backpack and pay for your travel insurance. The total for all of that will be £1,200.

You can add it to your total: £29,200 + £1,200 = £30,400.

How to save money for travel

If you have calculated the total amount that you should save and are now staring at it thinking: “Man, I really shouldn’t have sent that angry quitting email to my boss. This will never work out,” we are here to tell you: it’s all going to be okay.

Breathe.

Now. This is what you are going to do:

First of all, you will not panic.

If you really want to make this happen, you will.

Second, you will have a look at the 💩💩💩 we had to deal with when we were planning our full-time travel adventures. It wasn’t easy, but we made it. And we know you can do it too!

Third, you will make a financial plan. Here is what we did.

How to create a financial plan

It’s super simple.

Just open a Google Sheets document. You can use the one where you have calculated the number that gave you a heart attack.

Pop in the total amount you have to save before you can start travelling full-time (aka the devil’s number).

Now add in how much you already have. (If it’s zero, don’t freak out!)

Calculate the difference.

Now figure out how much money you can feasibly save per month. (be realistic)

Divide your difference number (what you need minus what you have) by this monthly saving estimate.

And voila – you have a timeline for your full-time travels!

An example

If this sounds confusing, this is what your calculation might look like:

In our example, we have calculated that you need £30,400 to travel the world.

Now let’s say you already have £4,000 in your savings.

How much you actually have to save up: £30,400 – £4,000 = £26,400

Let’s estimate you can save £700 per month.

To figure out how long it will take you to save: £26,400 / £700 = 38 months

It will take 38 months or just over 3 years before you have enough to travel full-time for a year.

Do all this in a Google Sheet though, because you can be updating your number as you save every month and see your savings go up and the number of months go down.

It has a calming effect, almost like chocolate or vodka. Trust us.

Pictured: taking a public bus to a wedding

A note on your financial plan (read this if you are absolutely freaking out)

If the number of months you are seeing seems way too high, find ways you can save more every month. Play around with the monthly number and see how the number of months changes, if you save £100 more each month. Or £150. Or £200… you get the point.

In our example, if you save £150 more every month, it changes the calculation to this:

£26,400 / £700 = 38 months

Vs

£26,400 / £850 = 31 months

You just saved yourself 7 months of waiting!

If you need help figuring out how to save more money, we used these 7 ways to save money for our full-time travels, so check them out. The post is full of useful tips that will help you save faster.

Alternatively, you can also adjust your daily average cost. Travel in cheaper countries. Or in a more budget style. There are many adjustments you can make.

You can also consider volunteering – that’s a great way to supplement full-time travel savings (that’s what we did).

Make your savings work for you

Want a quick, simple tip on making extra money?

Of course you do.

Here it is:

Create your savings account in a bank that will reward you for it.

What do we mean?

As you start saving up, you might as well let that money make you a bit more money.

How?

By getting paid interest on it.

Where can you do this?

We save with Monzo – they’ve got different savings pots you can choose from, including ones where you have an instant access to your money, any time you need it.

Basically, it’s like having it in a normal bank account. Except there you get nothing extra for it.

Whereas if you are collecting it in a Monzo savings account, it creates a little bit more money for you.

Even if just for one or two cocktails when you are finally on the road!

PS: if you open a Monzo account using one of our links, you will get an extra £10! All you have to do is create a Monzo account and make your first card payment in the next 30 days. We’ll get £10 too, so it’s a win-win!

We hope this post helped you find the answer to your question: “How much should I save to travel?” (and didn’t make you scream at your screen too much, especially when you saw the final number. Trust us. It’s doable.)

If you are unsure about anything or want to know more about budgeting for full-time travel, give us a shout in the comments or on our Instagram. We are always happy to help!

Hi!

We’re Mirka & Daniel — full-time travellers, professional overthinkers & bad luck magnets. We research EVERYTHING and then share all the weird travel tips with you here. Follow along to make your adventures easier! 🌴