Heard of True Traveller insurance?

Whether you’ve already got them on your radar or you’ve never come across them before, this True Traveller insurance review will give you the full lowdown.

Because let’s be real — if you venture out into the world, you want to know you’ve got great travel insurance that will have your back. Not just your wallet.

And this applies double when you are travelling long-term – the longer you are on the road, the higher the chance something will go wrong. 😬

So, is True Traveller the one? Let’s find out.

This post may contain affiliate links. For more information, please read our Disclaimer.

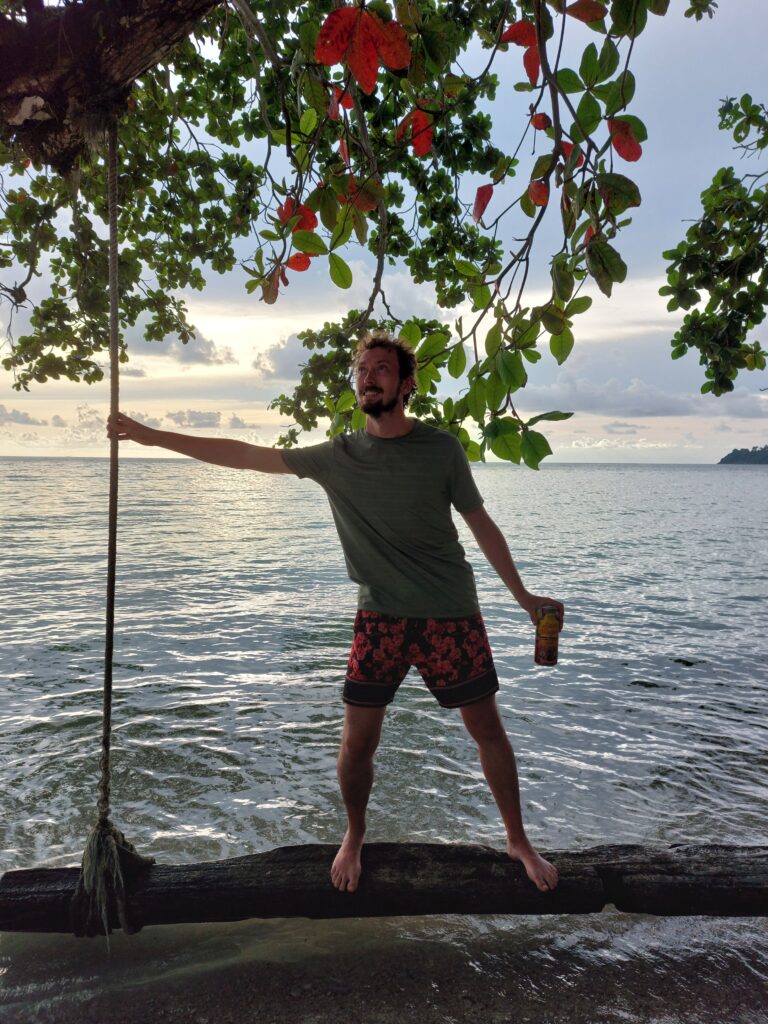

(and balancing on tree swings)

Here’s a little bit about our journey, if you are new here! If you know us, feel free to skip this part.

After leaving our old life in Scotland in March 2022 (it rains too much there), we travelled full-time for almost 2 years. Sounds fancy, doesn’t it? Well, it was. If you think that carrying overpacked backpacks in 45°C heat around streets that aren’t even on Google Maps is fancy. And that’s just 1% of all the fun we had! 😆

During the 2 years we volunteered in Italy and Bulgaria (free travel while learning new skills, anyone?), explored other amazing European countries and backpacked Southeast Asia. Btw, even our secret wedding was more of an expedition than a wedding. 😅

And, of course, we researched and planned everything ourselves, because you gotta keep the budget low, right? If you are like us, you’ve come to the right place, because we want to share all the useful travel tips and info with you!

Excited? Good. Let’s get into it so you can go on your own epic adventures too!

Remember: We are not financial advisors – all of this information is based on our own research and experience, so as always, do your own research, double-check the fine print and make sure any policy you buy actually fits your trip, your needs, and your chaos tolerance.

Our travel insurance research

If you know us, perhaps from following us on Instagram, you’ll know that we like to research things.

This is partly because we are mental we want to make sure we are safe when we travel, get the best deal and save money, and also because 💩 happens to us on a regular basis, so we try to be prepared as much as we can.

This is all to say we researched A LOT when picking travel insurance for our full-time adventures.

Want the specifics?

We looked into 23 different travel insurance providers.

Yes, it was as painful and boring as it sounds.

As you might have guessed, in the end, we chose True Traveller insurance to keep us company on our full-time backpacking journey.

We’ll tell you why in this post, but first, we wanted to make sure you know this wasn’t a quick decision.

We did all the work, looking through the different travel insurance options out there so you don’t have to.

Of course, don’t just take our word for it – check out True Traveller yourself before you buy.

Always do your own research before you buy.

But hopefully, this review will save you a ton of time – because we’ve already done the digging and found an awesome option (hi, True Traveller 👋) that ticked a lot of our boxes.

A bit about True Traveller

One of the things that instantly differentiates True Traveller from other insurance providers?

The company was created by three travellers.

Why does this matter?

Answer this:

When you go travelling, who do you want to insure you?

- Someone who is also an adventurer and so understands the different needs a traveller has as they explore the world

- A suit-and-tie person who runs a cover-all insurance company selling home, health, life and travel insurance, but, in the end, only cares about the company’s profits

We’d always pick another traveller, especially when buying insurance for full-time travels.

2 more things you should know?

- The company was established in 2010 – they’ve been around for a while

- They have a 4.8 rating on reviews.io and 4.4 on Trustpilot, and that’s with thousands of reviews!

(pictured: Kanchanaburi, Thailand)

Who is eligible for True Traveller insurance?

The great thing about the True Traveller insurance?

Even though it’s a British company, they offer their insurance not just to British residents, but also to European ones! (Note, residency is what matters, not your nationality.)

Another awesome feature?

They don’t start restricting you as soon as you get a bit older. You can get True Traveller insurance up to 65 years of age.

What kind of insurance does True Traveller offer?

We admit, the menu on the True Traveller website is a bit confusing, so here is what you need to know:

The two types of travel insurance True Traveller offers:

- Single Trip Insurance – for the one big trip you are doing (e.g. full-time travel), because it covers you on your travels for up to 18 months, and then you can still extend cover whilst you’re travelling (told you they were awesome. We cover that in more detail here.)

- Multi Trip Insurance – ideal if you do multiple trips a year, because it covers you on shorter trips (holidays or business) up to 10 weeks in length over a 12-month period

Carrying your life around in a backpack?

If you are going backpacking, first of all, pack light for crying out loud, don’t be like us. Second, True Traveller does have a Backpacker Insurance, although in their FAQ they clarify that this is the same as the Single Trip Insurance – just a different name for it!

3 levels of coverage

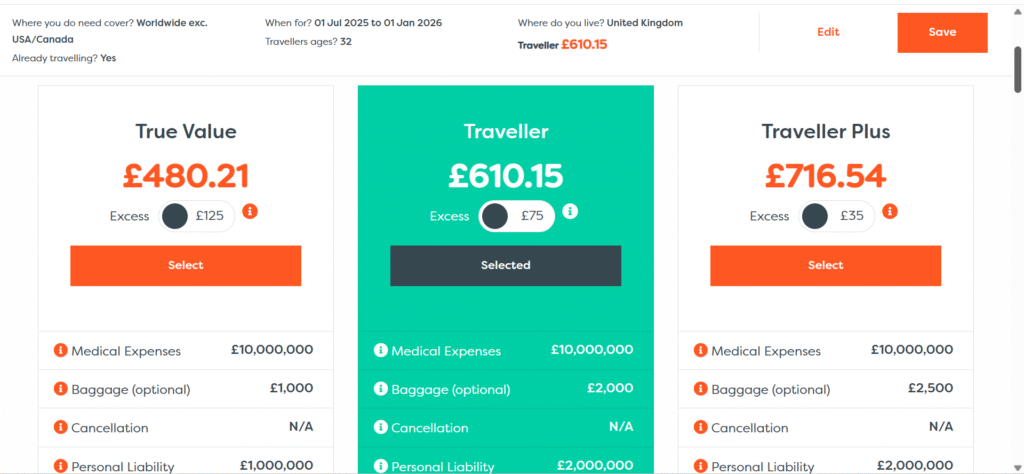

When it comes to the True Traveller single trip policy, it offers 3 different options:

- True Value

- Traveller

- Traveller Plus

The difference?

Levels of coverage (what is covered and for what amount) and the price you pay, of course.

This is one of the things we love about True Traveller insurance – you don’t have to pay for stuff you don’t need or want – you’ve got 3 levels of coverage too choose from.

The best thing to do is to see all three side-by-side, as they are displayed on the True Traveller website and compare.

The good thing is, True Traveller keeps things simple. So you won’t have to be comparing dozens of confusingly worded terms and trying to make sense of them all (trust us, there are more providers like that out there than you’d think. Some don’t even have a handy comparison for their different price levels!)

What you should do

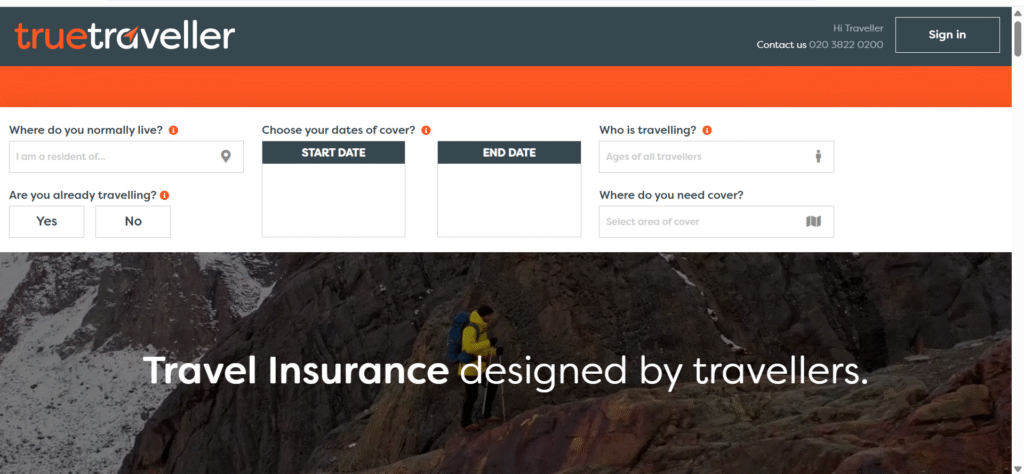

If you can’t wait and want to see how much True Traveller insurance would be for your next journey, you can go to their website right now and find out. They have a handy quote generator right on the homepage.

We won’t be upset, as long as you promise to then come back and finish this article! 😆

But that’s actually another cool feature of True Traveller: they don’t gatekeep their prices.

There is no “call us if you want to know how much it would cost you”. Yikes. We are millennials. Don’t make us call anyone.

Worst of all?

When there is a quote generator.

And you go through it, inputting all your details.

And then, at the end, they still tell you to call them to find out the price. 😭

The evil in this world.

So no, True Traveller won’t put you through such horrors.

You just go to their website, and right at the top is a quote generator.

And it’s:

- Simple – no filling out a million bits of info

- Anonymous – you don’t have to input any personal details aside from the country of residence and age

- Without restrictions – no need to enter an email address to see the price

- Fast – it says it takes 2 mins to generate the quote, but for us it’s always a few seconds max!

So if you want to know right now, how much it would cost you to get True Traveller insurance, pop over to their website to see.

We’ll see you back here in a few minutes.

Otherwise, let’s talk about the different cool features that the True Traveller insurance offers.

Why is True Traveller insurance awesome?

We talk a lot about travel safety, and that includes getting travel insurance.

Picking a good one, though, is not easy – there is a lot you have to consider.

This is why we put together the 11-question test – it’s a list of questions you should be asking about your potential travel insurance provider when you are going travelling, especially long-term.

True Traveller insurance? Yes, you guessed it, it totally passed our 11-question test.

Now, let’s talk more about the specifics that make them such a good option to go for.

Basic travel insurance requirements

Just briefly, let’s mention the things every decent travel insurance should cover; otherwise, there is no point in you even looking at it.

The True Traveller insurance is, of course, more than decent, so they cover:

- Medical expenses – up to £10 million

- Personal liability – up to £1 or £2 million, depending on the type of cover you choose

- Repatriation – up to £10 million

- Accidental disability*

- Legal expenses*

*The coverage limit here depends on the type of policy you choose

This is the bare minimum that your travel insurance should cover.

Start by doing this

Here’s what we would suggest you do when you start researching travel insurance providers:

- Understand the terminology used when it comes to travel insurance (e.g. what is repatriation)

- Make sure your chosen provider covers all the basics of a good travel insurance (as listed above)

- Check the limits of cover – up to what amount are you insured (e.g. the £10 million for medical expenses). This will be where you see differences between the different providers

As we said, though, this is the bare minimum you would expect from a travel insurance provider.

Now let’s talk about what really makes True Traveller insurance different.

One-way ticket to paradise, please

Something wild we discovered when researching insurance providers for our full-time travels?

Most won’t cover you unless you provide them with a return ticket for the end of your journey.

There goes the dream of buying a one-way ticket to French Polynesia and seeing how things go, right?

Thankfully, True Traveller understands that sometimes you might not want to come back.

Or you might just be travelling long-term and not know when exactly you will be coming back.

Or maybe you know when you will be coming back, but you don’t want to book the flight yet – you might be waiting for a sale or for your air miles to get added to your account.

Lots of different reasons, but not many providers understand them.

With True Traveller insurance, you not only have the option of buying on a one-way ticket, but they also won’t charge you any extra for it. Isn’t that awesome?

Already travelling? No problem

Similar to travelling on a one-way ticket is the issue of being already on the road when you buy.

Most traditional insurance providers will only cover you if your trip begins in your home country.

And no, you can’t fake it, because they will see the dates on your departure ticket!

Here’s the deal:

Most traditional insurance providers: your trip must start and end in your home country (boo)

True Traveller: you can buy our insurance even if you are already travelling, and you can end your trip wherever and whenever you want (within certain time limits, of course)

Another reason why this is a cool feature?

What if you need to extend?

Extensions (not hair ones)

What if you end up loving your travels and having enough funds, because you budgeted well? If you want to extend your travels, will you be able to extend your travel insurance to cover you too?

This is what we asked when we were planning our full-time travels and, unsurprisingly, True Traveller had a great answer:

Not only can you get travel insurance for 18 months right at the start, which is a really decent length of time, but you can also extend by up to 12 months afterwards. (T&Cs apply, of course.)

That means that you don’t have to be spending precious travel time researching a new insurance provider or even opening a new insurance policy with True Traveller – you can just extend your current one with them!

(Pictured: Cărturești Carusel bookstore in Bucharest, Romania)

Wanna go rock climbing? The activity packs

True Traveller insurance covers 92 activities as standard, meaning all of their policies automatically come with the pack no. 1: Traveller Pack.

This includes things like cycling, golf, hot air ballooning, non-contact martial arts training, snorkelling, surfing, zip lining and much more. And you don’t pay anything extra for it!

If you know you will be doing some more adventurous activities, though, True Traveller also offers 3 other packs:

- Adventure Pack

- Extreme Pack

- Ultimate Pack

You can add these as an extra to your policy, which is great, because if you are not planning on doing any of those activities, you won’t be charged for them unnecessarily!

Just check their website, where you can find a list of activities covered by each pack.

There is also a winter sports add-on – again, you don’t pay for this unless you need it.

Little extras that make a difference

It’s often the small things that will show you whether an insurance provider is good or not.

The two activities features offered by True Traveller that we love?

- There is a search function on their website where you can type in an activity you are planning on doing, and it will automatically show you which activity packs cover it. So handy – you don’t have to spend time looking through the lists if you know what you will do. (This search function appears once you generate a quote at the top of the page.)

- Travelling long-term and suddenly fancy going glacier walking? That’s not covered by the basic Traveller Pack — you’ll need the Adventure Pack for that. If you didn’t select it when you first bought your insurance, no stress. You can still upgrade your activity pack (i.e. buy one of the other 3 packs) even while your policy is active.

Home is where your heart is your insurance gets voided

It might sound crazy, but many travel insurance providers limit the number of times you can visit your home country during your trip away.

Some don’t even let you go home without voiding your insurance!

Say bye to family Christmas, or visiting grandma if she gets unwell, or attending your friend’s wedding.

As you might have guessed, you don’t have to worry about this with True Traveller insurance.

Your insurance will be paused while you are back home (meaning you won’t be covered), but you can resume it right after you get back on the road.

And you don’t even have to let True Traveller know, you just can’t be making any claims for anything that happens in your home country.

Oh, and you can go home as many times as you need, for as long as you need.

Awesome insurance?

Awesome insurance.

Hello, anybody there? 24/7 support

One more thing we want to highlight in this True Traveller insurance review?

The level of customer service support.

True Traveller, of course, offers 24/7 emergency support.

That, again, should be the standard you look for when choosing an insurance provider.

Accidents don’t only happen during 9-5 business hours, so make sure you can reach your insurance provider at all times.

What makes True Traveller insurance different

In our 11-question test, we emphasise how you need to talk to your potential insurance provider PRIOR to buying from them.

It’s all explained there, but basically, you want to know what it’s like talking to them.

If they can’t treat you well when they’re trying to win your business, imagine how they’ll treat you when you need to file an insurance claim.

So what’s our True Traveller insurance review when it comes to their communication?

5*!

Always fast, friendly, helpful, clear and efficient.

Exactly what you want when making a decision about travel insurance, but also if anything goes wrong.

Nothing worse than dealing with bad customer service when you are panicking because you are vomiting your guts out and need to be hospitalised (thankfully, this hasn’t happened to us. Okay, the vomiting part has. The being hospitalised part hasn’t. 😅).

True Traveller experience – making a claim

Surprisingly, considering our track record of bad luck (💩), we have only ever had to make one travel insurance claim.

And it so happened to be while we were covered by True Traveller insurance (we have used other travel insurance providers too, for full transparency).

The True Traveller experience of making a claim was so shocking, we had to write a standalone post about it.

You can read it here – especially if you still aren’t sure whether True Traveller insurance is worth it.

How much does True Traveller insurance cost?

If you have read this True Traveller insurance review and now think: “Great, this all sounds fab, but how much is it all going to cost me?”, we are here to tell you, you don’t have to worry.

If you haven’t tried the True Traveller quote generator yet, give it a go and you can see for yourself.

But when we did our crazy research of the 23 different insurance providers?

No one had a better price than True Traveller.

Sure, there might be someone who is cheaper.

But is cheaper the best option when it comes to taking care of your health, or possibly even your life?

It’s all about the value for money, and for what they offer, True Traveller worked out the best for us.

Oh, and much much cheaper than the other providers usually pushed by travel bloggers. We are sure you know which ones we mean. 😉

Don’t take our word for it though, pop on their website and get the price generated within a few seconds.

We were so happy when, after our crazy extensive research, we discovered True Traveller insurance.

If you are looking for a great travel insurance provider, check them out – you might just save yourself hours and hours of work, sifting through the bad and mediocre companies out there.

And the less time you spend researching? The more you can spend actually planning your travel adventures!

True Traveller insurance in a few quick Qs

UK and EU residents up to age 65 can buy True Traveller insurance. Residency counts, not nationality, and there are options for long-term trips or multiple short ones.

Yes, you can purchase or extend the policy during your trip. No need to start from home; just follow the time limits.

All policies include 92 activities like snorkeling and zip lining at no extra cost. You can also add extra activity packs for adventure sports, extreme pursuits, or winter sports if needed.

Check the True Traveller website for guidance based on the type of your claim. You can submit details online or by email – no need to send anything by post. You can even submit documents in a foreign language. When we submitted a claim with them, they handled it super fast and paid out without any issues.

For our full-time travels, True Traveller provided the best value for money – costing way less than competitors for similar coverage (we researched 23 different travel insurance providers!). Use their quote tool to see the price for your trip.

Yes, it covers long-term trips like our two years of travel across Europe and Asia. We chose it after researching 23 travel insurance providers for its backpacker-friendly features.

Check the details of the denial and contact them directly. Their customer service is fantastic and they always answer any questions clearly and fast.

Hi!

We’re Mirka & Daniel — full-time travellers, professional overthinkers & bad luck magnets. We research EVERYTHING and then share all the weird travel tips with you here. Follow along to make your adventures easier! 🌴